Structured Notes: What’s the Catch?

Jason Barsema, Co Founder and President of Halo Investing, recently appeared on the popular financial podcast “Animal Spirits” hosted by Ritholtz Wealth Management’s Michael Batnick and Ben Carlson. In the episode, Jason detailed the benefits of structured notes for advisors and their clients. With uncertainty in today’s stock market, a potential global recession on the way, and low bond yields in the face of high inflation, investors seek alternatives from stock and bond funds. The problem with so many so-called liquid alternative strategies is that returns can go through periods of sharp underperformance and fees are often high and opaque.

Today’s Structured Notes Through Halo: Transparent, Liquid, and Tailored

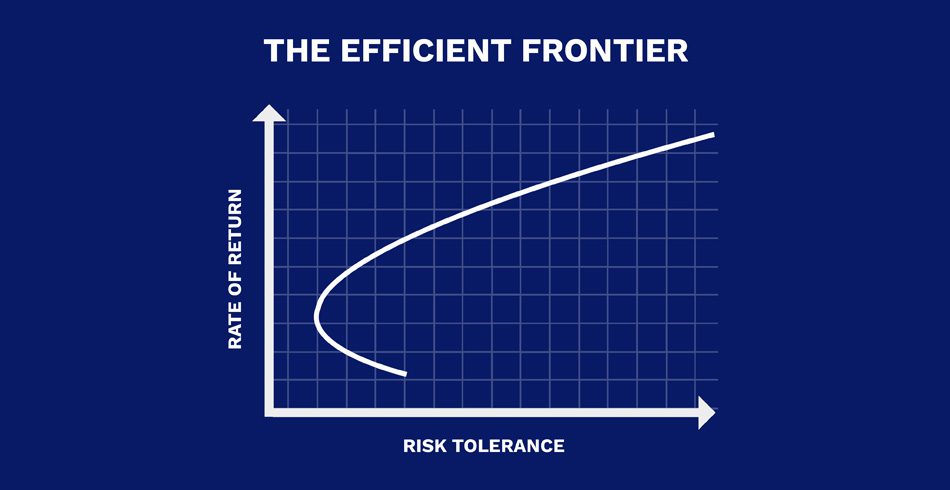

Structured notes offered through the Halo Investing platform, on the other hand, are income solutions with full transparency. Fees have been driven lower for this type of investment vehicle. What’s unique about Halo’s structured notes is that they can be tailored to a client’s risk and return objectives. As Jason put it when discussing how notes work with Michael and Ben, “We’re leveraging the technology at Halo to define and set specific risk parameters and rewards.”

Structured Notes Through Fiduciary Advisors: Relieving Investors’ Financial Anxiety

These defined-outcome strategies help investors sleep at night knowing they have investments suited to their situation. From a behavioral perspective, a portfolio built for the client is much easier for them to stick with during shaky times (think: the IKEA effect).

Halo believes that structured notes should have a place in the portfolio of risk-conscious investors – particularly those in and nearing retirement. Still, some critics paint notes with an unattractive broad brush. While no asset is a sure thing, by and large, structured notes have often been materially misunderstood. Technology and competition allow notes to offer potentially higher yields with material downside protection.

“So, what’s the catch?” you might ask.

Myth 1: An unsustainable yield.

A structured note is not too good to be true. As Jason put it on the show, “At the end of the day, it’s just a zero-coupon bond issued by a bank with a derivatives package on top.” So, it’s math. The yield is sustainable in the sense that the investor is paid an income stream so long as the bank can meet its financial obligations and certain market conditions happen.

Volatility in the options market allows some notes to yield above market rates. When volatility increases, that can actually benefit note investors since the options become more valuable, thus note yields increase. Moreover, rising interest rates can be positive for note buyers as it means a higher interest rate on the zero-coupon bond piece is made available.

Myth 2: You might not get your money back.

We take the credit strength of issuers on our platform seriously. Diversification by issuer is a common practice among our advisor clients, and we encourage them to always consider counterparty exposure risk.

It is also important to keep in mind that the only default-risk-free asset type is U.S. Treasuries. And those are not risk-free since investors take on significant interest rate risk. Consider that from August 2020 through early May 2022, a holder of a 30-year U.S. Treasury bond endured a more than 30% drawdown (including coupons). Structured notes can help protect investors from interest rate risk and volatility in the market when used to replace a portion of a traditional bond allocation.

Barring a credit default by the issuing bank, holders are paid out based on the terms of the note. Halo’s market offers structured notes with varying degrees of risk. Principal Protected Notes (PPNs) are designed for risk-averse investors as the downside is fully protected. Growth notes are used by investors seeking more upside potential and who can accept more volatility. Income notes are another choice that can act like a bond instrument.

Myth 3: Playing on investor fears.

Structured notes can be a solution to a problem. Advisors working with Halo can introduce clients to a new investment vehicle. Halo teams with more than 7,000 advisors in the U.S. and thousands more across the globe. It is our goal to bring investments that were once reserved for the wealthy to everyday people. And investors need income to confidently meet today’s rising cost of living.

Halo asserts that notes can be used for a slice of a portfolio – not the whole thing. We see many people replacing some of their fixed income exposure with structured notes, often within IRAs as a retirement planning solution. Halo also encourages thinking about more aggressive notes as part of an investor’s equity or alternative investment sleeve. To further the diversification point, 2022 illustrates the benefits of structured notes since their uncorrelated returns have helped offset losses in both the stock and bond markets.

Halo works with fiduciary advisors to provide defined-outcome investments to their clients. Our platform not only creates competition among issuing banks, but also uses easy-to-understand language and visuals outlining the upside reward, downside risk, and total costs of notes. It’s all in full view.

Myth 4: Opaque fee structure and no liquidity.

Technology and specialists such as Halo have helped make the market for structured products more mature, particularly in the U.S.. This has resulted in better insight into fee structures and access to a secondary market for structured notes. While there remains no guarantee an investor can sell a structured note after issuance, market liquidity has significantly improved in recent years. This has also generally resulted in tighter spreads. Halo’s work in derivatives pricing is one area of differentiation. Today, through Halo, financial advisors have access to leading edge analytical tools for structured products.

Conclusion

Like all investments, structured notes could be used based on each client’s unique risk parameters and return goals. While there are caveats to notes, there’s no dubious catch. Halo fosters competition so that costs are clear with daily liquidity for note-holders. Rising interest rates and high volatility work to the benefit of those seeking out notes by way of higher yields. Investors working with fiduciary advisors should have confidence that they can achieve their financial goals using notes offered through Halo’s marketplace.

Resource:

Animal Spirits episode transcript

Halo Investing is not a broker/dealer. Securities offered through Sentinus-Halo Securities LLC, a SEC registered broker/dealer and member of FINRA/SIPC. Sentinus-Halo Securities LLC is affiliated with Halo Investing Insurance Services and Halo Investing. Sentinus-Halo Securities LLC acts solely as distributor/selling agent and is not the issuer or guarantor of any structured note products.

.jpg)