The wealth management industry is shifting under our feet. A pronounced trend in the way advisors are paid has critical implications for the broker-dealer space and within the rapidly growing registered investment advisory (RIA) world. It used to be that a comprehensive financial plan included a consultative sales approach so that commission fees were generated for the advisor. Now, however, as ongoing planning and investment management have become more important (as opposed to a one-time sale of products to the client), a new model is overtaking the industry.

For example, just recently, several large broker-dealers launched corporate RIA models for fee-only advisors. The new model is geared toward advisors seeking the fee-based method, but who also don’t want to go down the RIA path.

Retail Investors’ Changing Preferences

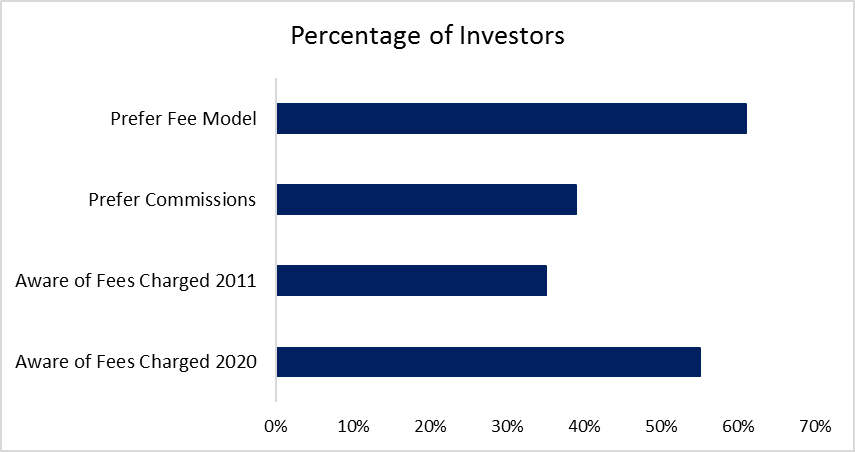

According to a 2021 study by Cerulli Edge, investor-fee awareness has dramatically increased. In 2011, just 35% of investors were aware of fees charged to them by advisors. By 2020, that figure surged to 55%. The same research found that most households prefer to pay for financial advice via an asset-based fee or by a rate for financial planning; just 39% preferred paying by way of commissions.

Figure 1: Investor Preferences Are Changing With More Fee Awareness

Source: NAPA-net.org

To Keep Talent, Go Fee-Based?

It’s nothing new to experienced investment professionals – the industry is shifting toward a fee-based model and away from the old-school method of charging commissions. The new-school twist is that heads of wealth management at wirehouses realize they too must align with the new compensation reality. The fee-based model is growing among large firms.

Retaining top talent now requires offering a solid fee-based approach. But making the shift in how advisors are paid is touchy. Cultivating client relationships is paramount, while allowing advisors the freedom and flexibility to change how they do business is also critical.

Satisfying Advisors’ Wants

Keeping the best advisors likely requires allowing for assets under management to continuously grow. That leads to bigger profits for large wealth management firms. Being able to pivot to the changing industry is required but doing so is no easy task. Broker-dealers are simply not used to the fee-based model.

Halo Helps Advisors Transition Models

That’s where Halo Investing fits in. Our experience includes helping large companies with the transition from selling traditional commission-based products to new fee-based models. Broker-dealers should take comfort in knowing that Halo has already guided many advisors that were also broker-dealers in successfully switching from being paid on commissions to going the fee-based route. And we can do the same for advisors employed at the large broker-dealers and wirehouses.

Addressing the Client Disconnect

A critical facet of fee-based planning and investment management is ensuring continued client connection. We find that it can be a struggle for advisors to maintain the same outreach with their clients when they are managing an asset allocation strategy that isn’t so transaction-based. So how can that disconnect be addressed? And what does Halo do about it?

Protective Investments Are Now Available as Fee-Based

That’s the beauty of Halo’s protective investment solutions. Structured notes and annuities within a fee-based model can provide a missing piece in the puzzle of proper client engagement. These products used to be sold with hefty commissions, but they are now available in a transparent and fee-based model, which can be particularly attractive to clients. Halo’s team works with advisors to convert assets to the fee-based approach. This doesn’t have to be a burden. It’s actually an opportunity.

Conclusion

Many financial planners find themselves at a crossroads: “Do I stick with the tried-and-true broker-dealer’s fee structure that has a big emphasis on commissions? Or do I go the independent route and get paid how I want to get paid?”

Halo Investing’s team and products help diversify business models within a single organization. We work with you to effectively transition from a commission-based model to the rapidly growing and widely popular fee-based approach. All while keeping advisors and clients engaged, motivated, and satisfied. It’s not about charging more fees – it's about aligning an advisor’s services and value to emerging client preferences and needs.

Halo Investing is not a broker/dealer. Securities offered through Sentinus-Halo Securities LLC, a SEC registered broker/dealer and member of FINRA/SIPC. Sentinus-Halo Securities LLC is affiliated with Halo Investing Insurance Services and Halo Investing. Sentinus-Halo Securities LLC acts solely as distributor/selling agent and is not the issuer or guarantor of any structured note products.

.jpg)

.jpg)