There is a common misconception that structured notes are an asset class. Given the levels of abstraction unique to high finance, such confusion is entirely understandable. More specifically, structured notes are a “structure”—hence the name—that can serve as an effective vehicle for shielding portfolios from volatility common to traditional asset classes.

While there is no universally accepted definition of what makes up an asset class, the United States’ leading regulatory agency, the Securities and Exchange Commission (SEC), identifies three primary areas which make up the bulk of portfolios: stocks, bonds, and cash.

Beyond these three broad categories, it is commonly said that other asset classes exist—such as real estate, commodities, and even currencies. Defining an asset class is done by grouping investment segments that have similar risk and return characteristics. Because structured notes can be constructed with nearly countless components, it is difficult to pigeonhole them into a stand-alone asset class. As such, the flexibility available in structured notes results in many advisors using notes within their alternatives sleeve when determining asset allocation strategies.

A Metaphor: Structured Notes as a House

A good metaphor for a structured note is a house that needs furniture. A note’s “furniture” is often a zero-coupon bond (within the fixed-income asset class) and an options package. As a point of caution, options are derivatives and therefore not an asset class in their own right.

Understanding the Four Pieces of a Structured Note

Structured notes help investors target and achieve a level of expected return—their payoffs can be tailored to be relatively low-risk or high-risk depending on the underlying assets. That’s the beauty of this type of investment vehicle as opposed to more-confined asset classes. Moreover, structured notes can have the potential upshot of defining payoff outcomes over a specific timeframe. Clients can be protected from price declines in traditional asset classes through the structured note vehicle.

Managing Risk & Return

Structured notes are a powerful portfolio tool for managing risk. The vehicle can be used to help people gain control over their portfolios with defined outcomes. In general, you can think of structured notes as a mix of the equity and fixed income asset classes in terms of their risk and reward profile. In some cases, structured notes can offer more upside than bonds with lower risk than stocks. Holders of structured notes can benefit from capital protection, yield enhancement, and some level of upside participation.

A Core Holding in a Portfolio

Although portfolios are generally made up of stocks, bonds, and cash as direct holding, notes can be a core holding as well. Higher-risk structured notes are often considered part of the equity asset class, while lower-risk notes could be included in the bond segment—it all depends on the risk/return profile of the note.

Higher Return, Lower Risk Potential Through Structured Notes

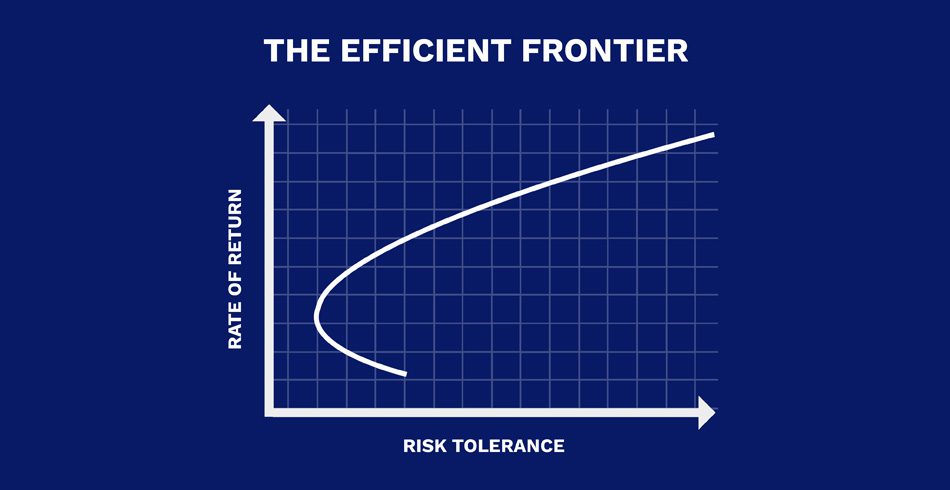

Structured notes are used to fit a portfolio’s risk/return profile to an investor’s desires. They help tailor portfolios versus cookie-cutter stock/bond/cash mutual funds. The chart of the Efficient Frontier below demonstrates that, in general, investors must take on more risk to earn higher long-term returns. Structured notes are often used to give up some return for a significant drop in risk. Ergo, structured notes can help push the Efficient Frontier up and to the left.

Figure 1: Illustrative Efficient Frontier

Figure 2: Structured notes can be a vehicle to push the Efficient Frontier up and to the left

For illustrative purposes only. This is not indicative of any particular security, asset class, or investment strategy. This chart is intended to demonstrate only how the Efficient Frontier works theoretically. Additional perspective is available here.

Conclusion

Historically, investors were largely limited to the traditional asset classes of stocks, bonds, and cash. Halo has democratized the structured note market so that advisors can make this vehicle more accessible, cost-effective, and with much greater transparency versus yesteryear.

To clear up a common misconception, structured notes are not an asset class—rather, they can be used alongside traditional asset classes. An aggressive structured note can be included in the equity segment of a portfolio, while a structured note with a conservative risk/return profile can be considered a piece of the fixed income pie. Furthermore, investors looking for an alternative to alternatives can use notes to refine investments in any number of asset classes, including real assets, commodities, or currencies.

About Halo

Halo Investing is an award-winning technology platform for protective investment solutions. Headquartered in Chicago, with offices in Abu Dhabi, Zurich, Dubai, and Singapore, Halo was co-founded by Biju Kulathakal and Jason Barsema in 2015 with a mission that focuses on putting “impact before profits,” providing access to impactful investment opportunities previously unavailable to most investors. Through the Halo platform, financial advisors and investors can easily access structured notes, market-linked CDs, buffered ETFs, and annuities, as well as a suite of tools to educate, analyze, customize, execute, and manage the most suitable protective investment product for their portfolios. Halo has received a growing number of honors and was recently named one of Fast Company’s Ten Most Innovative Companies of 2021. For more information, please visit: http://www.haloinvesting.com

Halo Investing is not a broker/dealer. Securities offered through Halo Securities LLC, a SEC registered broker/dealer and member of FINRA/SIPC. Halo Securities LLC is affiliated with Halo Investing Insurance Services and Halo Investing. Halo Securities LLC acts solely as distributor/selling agent and is not the issuer or guarantor of any structured note products.

.jpg)