Previously only available to wealthy investors, structured notes play an active role in portfolios by protecting against market volatility, while providing upside return potential. In this post, we’ll go into the details of the type of structured notes available to investors and how they can be used in portfolios.

One of the many benefits of structured notes is the number of choices with the vehicle. This is great for investors because of the flexibility in risk-return options available that can be personalized for different portfolios.

But since the choices of different note features and variations are almost endless, it can be overwhelming at first, but powerful if used the right way.

In the post below, we’ll go into the details of the type of structured notes available to investors and how they can be used in portfolios.

Structured Note Basics

Structured notes are investments issued by banks and are ultimately designed to give investors a level of downside protection.

Traditionally used by institutional investors or in the private banking world with the ultra-wealthy, structured notes are now available to most investors via financial advisors. Technology has given access to many new investors making the market more efficient and transparent, with lower fees.

Structured notes are a large market globally, with more than $3 trillion outstanding. They were born in Europe in the mid-1970s, and the first structured note was created in London and further made popular in Switzerland and Germany.

Compared to structured notes abroad, the products are very much a retail investment in Europe and Asia. This is very different from the United States where many investors haven’t used or know much about the structured investment products that are available.

Getting Familiar with Structured Notes

First, let’s define each of the four basic components of structured notes. Understanding these four pieces can help when looking at any structure. It will also give you an idea of the variables you can choose and adjust when creating your own structured notes.

Structured notes can be tied to various underlying assets, vary in term lengths, and include protection options. There’s also the level of return, or yield, that investors seek when using structured notes.

- Maturity

- Underlying Asset

- Protection Amount/Type

- Return/Payoff

Maturity – This is the time period over which a structured note is held. Maturities can range from 6 months to 20 years, and in most cases structured notes maturities are between two and five years.

Underlying – The performance of a structured note generally tracks the performance of an underlying asset – an index, stock, group of stocks, commodity or foreign currency – over the maturity period.

Protection – this is the amount an investor is protected against price declines in the underlying asset. As long as the underlying asset is not down further than the protection amount, the investor gets their principal back and is not exposed to further losses. This can come in the form of either hard protection or soft protection.

- Hard protection: a more conservative type of protection, hard protection acts as a buffer against losses. If the underlying price decline breaks the protection level, the investor will only be exposed to losses past the protection amount.

- Soft protection: this type of protection acts as a barrier against losses. If the protection level is breached, the investor is exposed to the full losses of the underlying asset. Because of the additional risk with a barrier, you can get potentially more upside returns compared to hard protection.

Return/Payoff – the amount the investor receives over the term of the note if certain market conditions are met. There are two basic types of return/payoff structures that cover the majority of note types, but many others that we will touch on further below.

- Income: provides investors with a fixed return level with periodic coupon payments

- Growth: gives investors a level of upside participation on the underlying asset

When combining the four variables above, an investor can create a note for almost any investment objective.

Structuring a Structured Note

Now that you have the four main pieces of a structured note, what are the different ‘structures’ for structured notes?

How does each structure note type behave in different markets? How does an investor decide which type of structured note to utilize?

The variety of notes that can be designed, means there is generally some type of note available for just about any investment goal.

The basic ways structured notes can be ‘structured’ are the following:

- Provide downside market protection

- Provide upside (or enhanced) participation

- Provide regular payments/income in the form of coupons if certain market conditions are met

- Provide a payout/return at maturity if certain market conditions are met

By way of comparison, consider the bond market. An investor can invest in Treasury bonds, corporate bonds, municipal bonds, emerging market bonds, etc. The different types of bonds vary on the scale of risk versus return.

Structured notes’ core component is a zero-coupon bond issued by a bank with a derivatives package. Having the characteristics of both capital protection and upside potential, structured notes can be quite diverse and cover a wide range of portfolio objectives.

Investors may also use options strategies as a form of hedging against price movements and volatility. Since structured notes do include an options package, an investor could certainly put together the same investment strategy with call, put and binary options both at the money and out of the money, depending on the structure they’re seeking.

That’s why a structured note, with the flexibility of payoffs, maturity and underlyings makes the vehicle efficient and convenient. The number of note types makes customizing a note more feasible for varying investor goals.

Structured Notes in Portfolios

Investors seek greater control over their portfolios with defined outcome investing. Structured notes can be a powerful portfolio tool because of their flexibility and customization options that can be tailored to client needs.

We see many investors and clients using structured notes as a core holding. By selecting any asset class where downside protection is desired, a structured note can provide a risk/return tradeoff.

Investors also use structured notes as tactical holdings to play on investment themes, sectors, or other trends in the markets that would be difficult to implement otherwise.

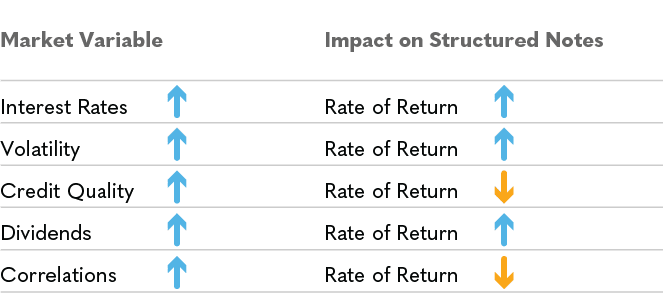

Market Environment Affects Note Pricing

Structured note returns/pricing is dynamic and moves with market variables. Below is a sample of market variables and how they impact structured note returns:

Since structured notes feature both a zero-coupon bond and options package, the investor is able to participate in upside movements if desired, and also protect against negative price movements on the downside.

Through the Halo platform, any type of custom structured note is available. These include (but not limited to): Income Notes, Growth Notes, Principal Protected Notes (PPN), Absolute Notes, and Digital Notes.

As we mentioned above, the majority of notes fall into the income and growth categories, so we’ll start with these two types first.

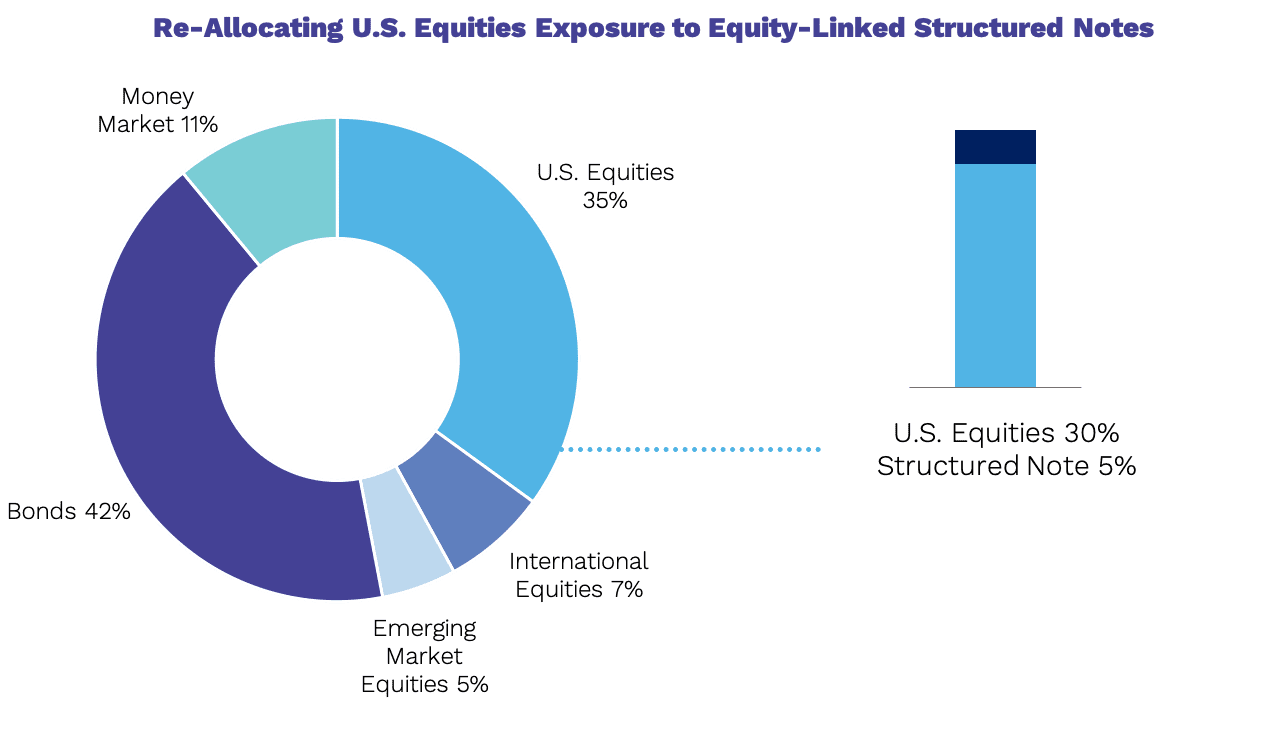

When structured notes are tied to stocks, ETFs or a group of stocks they should be considered a complement to the equity portion of a portfolio. Further, if the stock or index of the note is tied to small or large-cap, for example, they should be included in that allocation, respectively.

Income Notes

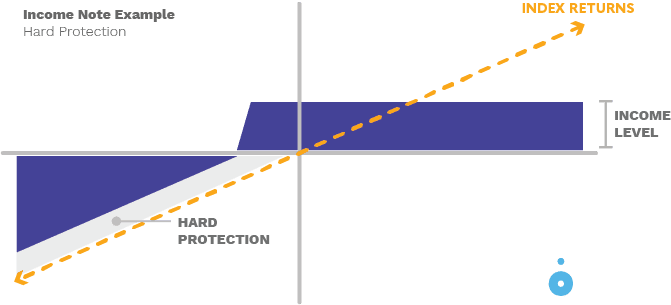

Income Notes can provide income in the form of coupon payments (much like traditional bonds). Like most notes (and less like most bonds), they can be used to express a wide range of market sentiments and are highly customizable.

A common use of an Income Note is as a core portfolio holding for income, similar to a bond. Instead of holding an index (ETF or mutual fund) or a basket of stocks, an Income Note can be used as a replacement in the equity allocation. It often provides a higher yield than a standard fund’s dividend or a traditional bond’s coupon payment. Perhaps more importantly, an income note will generally offer a measure of downside protection.

Income Notes can also be used as tactical investments (on both ETFs and stocks). Tactical income notes tend to provide higher yields than core notes, more downside protection, or a combination of both.

Let’s look at some general characteristics of Income Notes:

Payoff:An Income note’s potential positive return is limited to its periodic coupon payments. Coupon payments for Income Notes can be configured to pay on a guaranteed or contingent basis at a frequency that is determined by the investor.Despite the product’s lack of participation in the positive performance of an underlying reference asset, most Income Notes are exposed to some potential downside performance of the underlying. The level of downside exposure is dependent on how the note is structured.

Terms:

- Fixed term (typically anywhere from 3 months to 20 years, potentially longer)

- Early termination is possible via Autocallable or Issuer callable, for example. A holder will receive any payment due (usually a return of principal and a final coupon payment) and will no longer be entitled to any additional coupons if its called.

- Autocallable: redemption of the note occurs upon certain stated conditions – typically if an underlying asset crosses a specific threshold

- Issuer Callable: redemption of the note can be at the discretion of the issuer on a specified date(s) at an amount specified in the terms of the note, if applicable

Example payoff chart:

Growth Notes

Where an Income Note is focused on collecting coupon payments, a Growth Note (also called Participation Note or Tracker Note) provides the opportunity to participate in the upside performance of an underlying asset. A Growth Note may be tied to any positive performance or limited to a range of positive performances from a basket of assets.

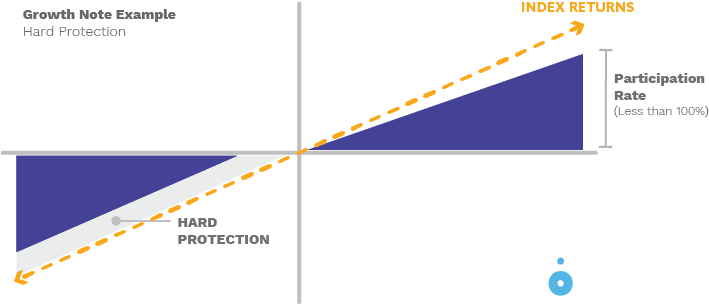

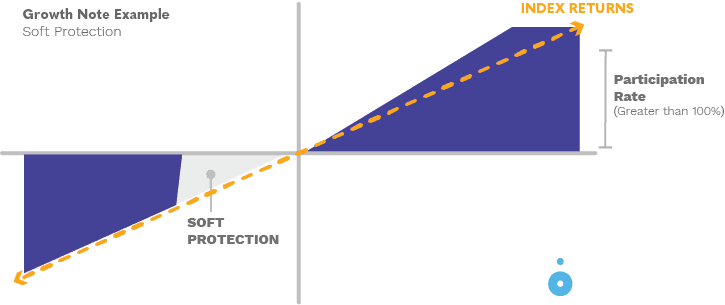

Growth Notes can allow the investor to benefit from stock or ETF price appreciation while also potentially limiting downside exposure. Upside participation can be greater than 100% in some instances. The tradeoff is typically a balance between upside potential and downside exposure through either soft or hard protection.

The tradeoff between hard and soft protection is very much a product of the market environment and client risk preferences. Soft protection can provide greater participation on the upside, but hard protection is more conservative for investors that may want more comfort against downside risk.

Example payoff chart with hard protection:

Again, with soft protection – if the protection level is breached by the underlying, an investor is fully exposed to downside losses just as if you owned the asset outright.

Hard protection offers a buffer against potential losses, so negative performance of underlying will be reduced by this fixed amount, but normally has less participation to the upside.

With comparable notes – underlying, maturity, issuer, and protection amount (e.g. 30%) – but hard vs. soft protection, there will normally be more upside potential with soft protection and more downside protection with hard.

Example payoff chart with soft protection:

These are a few of the tradeoffs between hard and soft protection, and normally there is no right or wrong answer, just what makes more sense in client portfolios.

Like Income Notes, Growth Notes can be used to complement core portfolio holdings (a stock index ETF for example), which most investors will have in their portfolios. So just like having house insurance, or car insurance, a Growth Note tied to a major equity index can provide some added protection.

Growth Notes can also be used for tactical purposes (for instance, participating in the worst-of upside between two similar stocks), or for tactical tilts in portfolios. If there are portfolio holdings (stocks, ETFs, etc.) that have recently declined but fundamentally are still intact, growth notes with protection can provide a tactical opportunity to participate without having to time the inflection/rebound point of the underlying.

If there are stocks that an investor has a large exposure to, or stocks that are higher in volatility, an investor can use a Growth Note as a form of downside protection with some upside potential.

Payoff:The participation rate of the underlying. However, there is no assurance that the performance of the underlying asset will actually result in any profits; or positive return of the Note.

Income and Growth Notes make up the majority of the structured note market (at least 90% of outstanding notes). However, there are other note types offered on the Halo platform that are worth exploring.

Absolute Notes

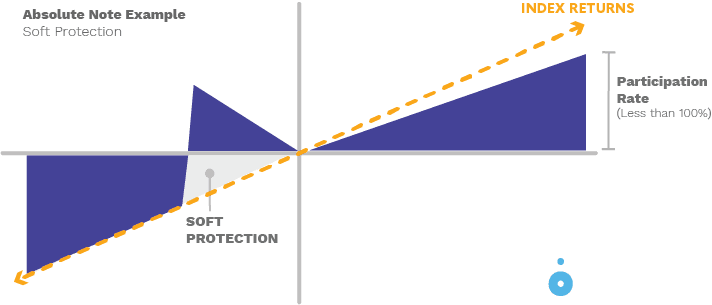

Absolute Notes (sometimes called Dual Directional or Absolute Performance) allow an investor to participate in the positive performance of an underlying asset and a limited amount of negative performance.

The negative performance is typically capped at the protection level of the note. This may be attractive for an investor that is seeking a limited range of returns on an absolute level, positive or negative.

The positive performance is often capped at a certain level of participation (generally dependent on how much downside participation is in place).

This type of note allows investors to potentially profit from an underlying asset in a bull or bear market environment. This feature means an Absolute Note may be appropriate for investors with an uncertain outlook on the market (or for a stock or basket of stocks).

While an Absolute Note provides a certain amount of negative participation in the underlying asset, beyond a certain point, the note holder will be exposed to downside risk. The payout is only dependent on where the asset is priced at maturity.

Example payoff chart:

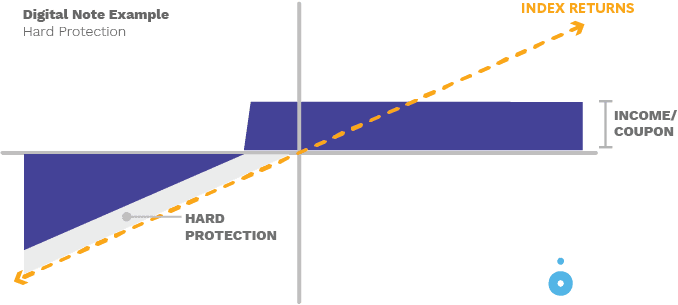

Digital Notes

A Digital Note (sometimes known as Step Payment) is very similar to an Income Note, except the Digital Note pays one coupon payment at the maturity instead of at fixed intervals during the duration of the note.

Like an Income Note, the Digital Note will pay the coupon amount if the underlying asset is above a certain downside threshold at maturity. Because the note doesn’t pay a coupon until maturity, the terms are often shorter than a traditional Income Note.

Example payoff chart:

Principal Protected Notes (PPN)

PPNs are notes that are market-linked with full principal protection from market-related losses. They usually pay a market-linked return. Although there is no downside risk to the investor, there is still credit risk of the issuing bank.

PPNs are generally designed for risk averse investors as the downside is fully protected (barring a credit default from the bank, as mentioned above).

Implementing Structured Notes

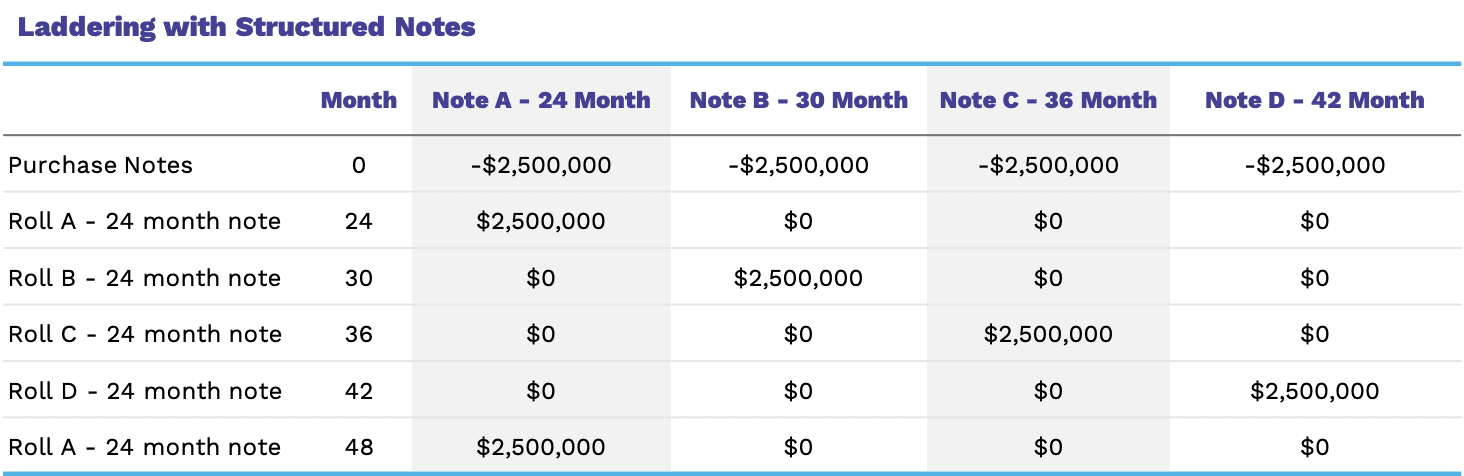

Laddering, originally in the context of bond investing, is a diversified portfolio strategy that can be used with structured notes. By laddering, investors can manage maturity dates and decrease the timing risk of the underlying asset price at maturity. Since performance is contingent on the underlying asset’s price at maturity, there is a good argument to be made for spreading out structured note maturities, in order to protect against market volatility.

By using structured notes, you can build strategies that use longer-dated options which provide better terms for the investor. Below is a simple example of a laddering plan which creates a new liquidity event every six months, starting in the 24th month.

This cadence can continue in perpetuity, assuming the issuer of the notes can payout the terms of the note. By spreading out the maturities by six months, you drastically reduce the risk of “breaching” your downside protection across your structured note allocation in aggregate.

Manage Structured Notes the Right Way with Halo

Finding relevant investments that deliver attractive risk/return has never been more important—or more challenging. But when it comes to positioning client portfolios, defined outcomes can help. Halo’s custom note creator allows you to create a structured note for your given objectives, like income, growth, or protection.

It starts with choosing an underlying asset, a time frame and protection level—then Halo’s platform connects financial advisors to leading global issuers of structured notes.

Are you bullish? Soft protection and a higher participation rate could work. Bearish? Hard protection will provide peace of mind. Uncertain? Potentially choose an income note for a steadier return stream, or an absolute note which can be up when your underlying is down.

As you can see above, there are a wide range of structured note types available to investors. This should serve as a starting point to finding the right type of structured note to implement given your clients’ unique investment objectives.

Securities offered through Sentinus-Halo Securities LLC, a SEC Registered Broker/ Dealer and member of FINRA/SIPC. Sentinus-Halo Securities LLC is affiliated with Halo Investing, Halo Investing is not a broker dealer. Sentinus-Halo Securities LLC acts solely as distributor/selling agent and is not the issuer or guarantor of any structured note products.