With more options available in the buffered ETF category, many investors still might be unfamiliar with this new type of product. In this post we explore the details behind this new type of ETF – features, investment strategy, portfolio allocation options and more!

Buffered ETF Basics

Traditional ETFs have become an important part of most investment portfolios, totaling more than $4 trillion in assets under management in the U.S. The convenience and transparency of the ETF vehicle has made it appealing to investors for all portfolio sizes. Daily liquidity, tax efficiency, lower fees, small investment minimums, and transparency make it highly utilized.

Buffered ETFs have recently entered the fray. These ETFs track an index over a defined period of time while offering a degree of downside protection, known as a “buffer.” Investors can also participate in the positive returns of the index to a predefined level, the “cap.”

Sometimes referred to as structured ETFs, defined outcome ETFs, target outcome ETFs or buffered outcome ETFs – there are a handful of names used in the marketplace depending on the issuing firm. We’ll refer to this type of ETF throughout the article as Buffered ETFs for consistency.

Despite the different names, Buffered ETF strategies share a few common traits:

- Track the price returns of a specific index

- Seek to provide a level of downside protection

- Participate in upside returns up to a stated cap

- Have a maturity date at a specific point in the future, normally 12 months

So, there are four main components of Buffered ETFs:

- Market Index

- Upside Cap

- Downside Buffer

- Outcome Period

Possible Outcomes In Different Markets

Investor mindset has shifted to risk management and continues to be a crucial part of the investment process. The balance between risk and reward is important for any client, many of which have seen unprecedented levels of volatility in 2020 so far.

Risk based goals still remain top of mind, while broad-based outcomes can differ depending on life stage and retirement goals.

But the markets are experiencing a unique time in history – sustained low interest rates and volatility have been accentuated by an increasingly connected global market.

A decreased appetite for risk has also led to lost opportunities for long-term investment returns. This is a major reason why buffered ETFs were created.

Buffered ETFs solve a long-term problem by letting investors stay invested when choppy markets might cloud an investor’s decision making. It’s harder than ever to remain a long term investor, and nearly impossible to time the market.

Panic selling can be a costly reaction to volatility, while buying high and selling low is an all too common investment experience.

Buffered ETF strategies fill the long-term need of staying invested in the markets with a proactive, long-term approach while planning for retirement.

How are Buffered ETFs Created?

With a little background into why buffered ETFs were created, here are some details into how they are constructed.

Buffered ETFs are typically created with FLEX Options. FLEX Options allow for customized terms of an option, including strike prices, underlying reference assets and expiration dates. They are also traded on an exchange, listed on the Chicago Board Options Exchange, and backed by the Options Clearing Corporation (OCC).

The OCC is guarantor and central counterparty with respect to these options. As a result, the ability of a buffered ETF to meet its objective depends on the OCC being able to meet its obligations.

Designated as a systemically important financial market utility, the OCC has heightened risk management and liquidity standards, significantly reducing counterparty risk. Buffered ETFs are not backed by the credit of an issuing institution, and therefore not subject to credit risk.

Buffered ETFs hold an actively managed basket of FLEX Options chosen with strike prices that expire on the outcome period end date.

Buffered ETF Investment Strategies

There are normally four layers to the buffered ETF FLEX Options strategy. First, a call option is bought on the reference index for the future maturity date, normally 12 months ahead.

Second, to get the downside buffer the fund will purchase puts for the outcome period end date on the reference index.

Thirdly, to offset the expense of buying those puts, the fund will sell puts further down which corresponds to the ETF’s buffer level.

The fourth piece is selling a call option which caps the return of the ETF versus the reference index, this is how the cap level is determined for the outcome period.

In summary, the rate of return if bought at the beginning and held the full outcome period, the buffered ETFs broadly depends on two factors: the underlying index return, and the terms of the FLEX Options at the start of the outcome period.

Creating A Payoff Chart

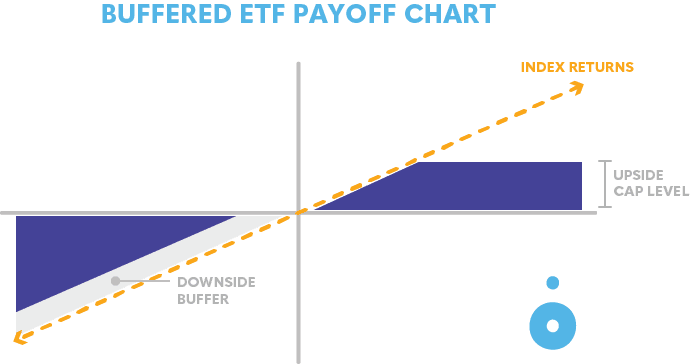

Common downside buffer levels for ETFs in the market are 10% and 20%, meaning that there is a cushion on the first 10% or 20% declines of the reference index, respectively.

The upside cap, which is determined at the buffered ETF start date, depends on the options market at the time the hedging takes place. After the buffered ETF is launched, the remaining upside cap and downside buffer moves real-time intra-period depending on market performance of the reference index and corresponding ETF share price, since the start date.

It’s also important to note that the FLEX Options are only on the price returns of the reference asset, meaning no dividend income on the underlying index.

Here is an overview of a buffered ETF payoff chart for the given reference index returns.

When You Purchase Them Is Important

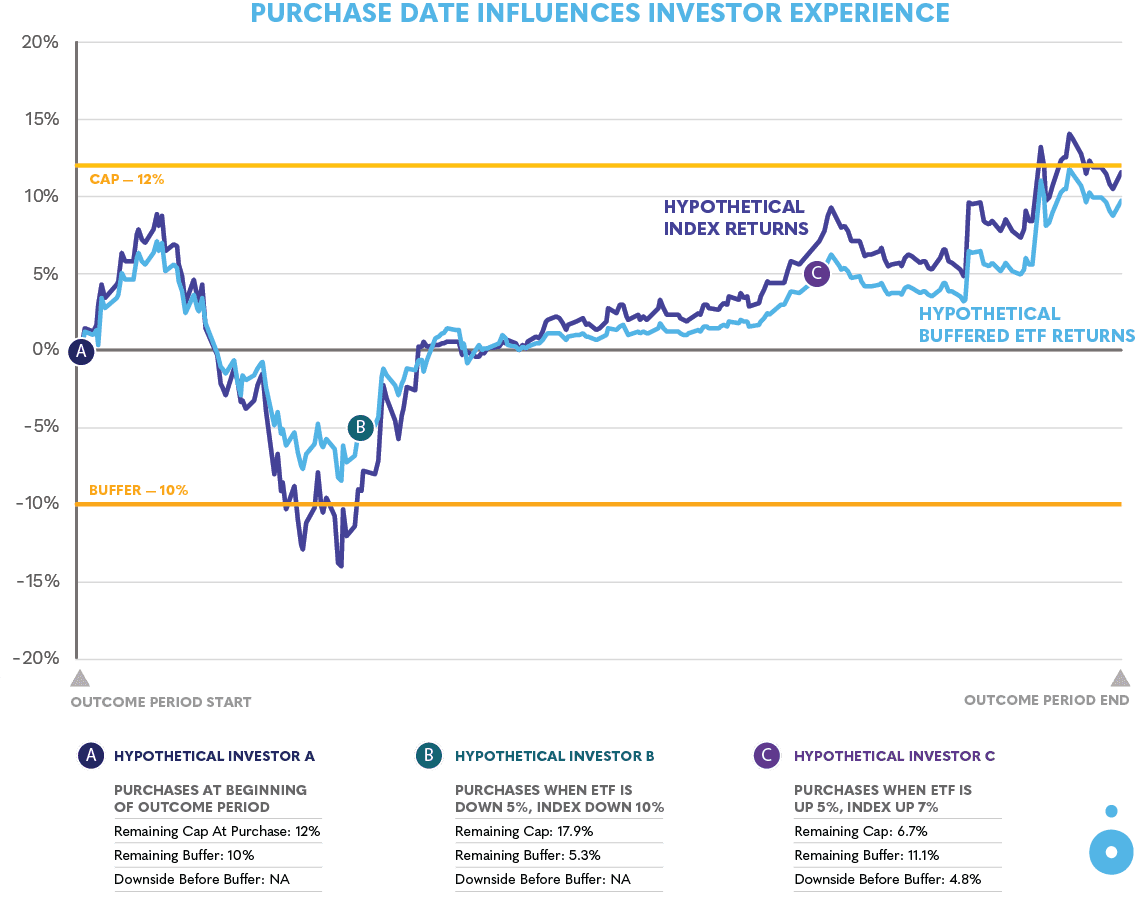

Investors can buy buffered ETFs at any point in time, either at the start date or any day after. Just like with other investments, your purchase price is especially important with buffered ETFs.

Each buffered ETF has a set share price on its first day of being issued. Just like a traditional ETF, a buffered ETFs share price (NAV) will move as it tracks the underlying index.

For investors who invest at the start of the outcome period and hold for the entire outcome period, stated cap and buffer levels apply.

For investors who buy intra-period after launch date and hold for the remainder of the outcome period, remaining cap and remaining buffer levels at the purchase price apply.

For investors who sell intra-period before the outcome date, cap and buffer levels do not apply. Returns will be based on market value of the buffered ETF.

The below chart illustrates the hypothetical investment experience for three different purchase dates depending on remaining cap, buffer, and loss to buffer levels.

It’s important to be aware of these three variables when purchasing a buffered ETF.

- Remaining cap

- Remaining buffer

- Remaining loss to buffer

For example, buffer levels (5%, 10%, 20%, etc.) are from the price level that the ETF was issued at the start of the period. Meaning if the ETF is currently priced at $12 per share, but the issue price was $10, about a $2 loss per share is possible for the investor before the downside buffer kicks in.

These buffered ETFs are designed to provide point-to-point exposures to the price return of the reference index. They are not expected to move precisely in line with each index during the interim period (due to the optionality of the underlying portfolio).

As illustrated in the chart above, buffer and cap levels are dependent on the relationship between the index and ETF if purchased after the start date. When factoring in the options premium with ETF price level, there is a variable relationship between the buffer and cap with the index return levels.

Having real-time data on remaining cap, buffer and loss to buffer levels is important when purchasing buffered ETFs.

What Do You Mean Buffered ETFs Mature?

Unlike traditional ETFs, each buffered ETF has a set time period that it trades, normally 12 months. At the end of the outcome period, buffered ETFs roll into a new set of options contracts with the same buffer level and term length, but also a new upside cap.

When a buffered ETFs resets at the end of its outcome period, the cap level also resets and may be higher or lower than the preceding period, depending on options market conditions as described above.

This also means that an investor can hold them indefinitely.

A ‘reset’ or ‘roll’ of the buffered ETF means the shares can continue to be held. The buffered ETF continues to trade under the same fund name and ticker indefinitely and resets after each 12-month period with a new upside cap.

How Do Buffered ETFs Fit in A Portfolio?

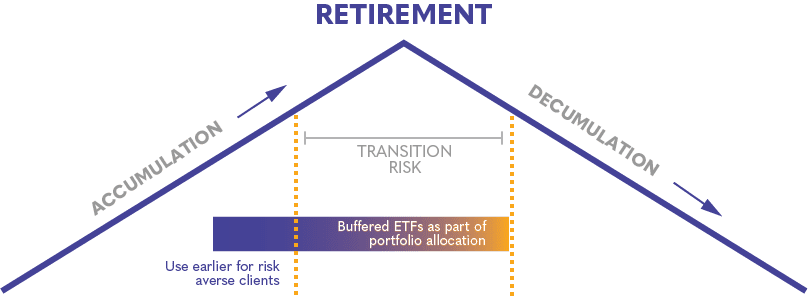

Useful across the entire investment lifecycle, buffered ETFs can be used for exposure to returns on the upside but for investors also nervous about market drops.

These types of ETFs may be especially important for the transition risk nearing retirement or entering retirement. An estimated 10,000 baby boomers will turn 65 every day until the year 2030, according to Pew Research Center.

Portfolio losses as a result of inopportune market swings is particularly relevant when nearing retirement. Unfortunately, a down market at the wrong time can deplete retirement savings sooner than planned.

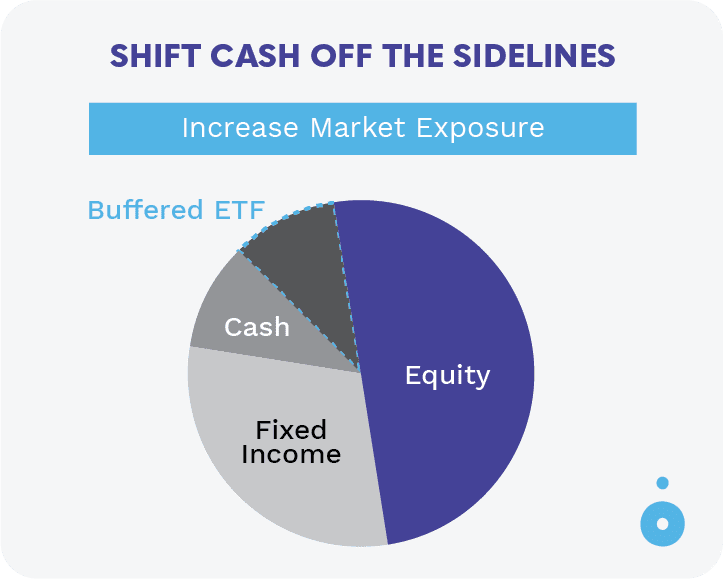

There’s also a significant amount of cash held in investment portfolios that could be put to work. With a more conservative approach, investors are allocating more to fixed income or cash instead of holding equity exposure.

According to the Federal Reserve, there is more than $19 trillion in assets held in money market funds, checking accounts, or savings accounts/CDs.

Due to this level of uncertainty and high levels of cash, buffered ETFs can provide a level of loss mitigation and upside potential in portfolios.

Buffered ETF Portfolio Use Cases

Next we get into how investors can use buffered ETFs in their portfolios.

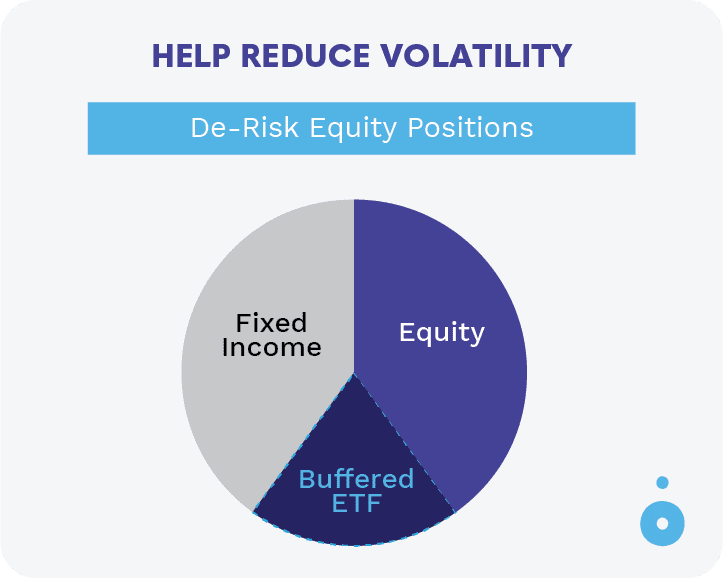

1. Help Reduce Volatility – De-Risk Equity Positions

- Reposition a portion of domestic equity exposure to potentially help:

- Reduce downside volatility with the buffer

- Maintain a level of equity upside

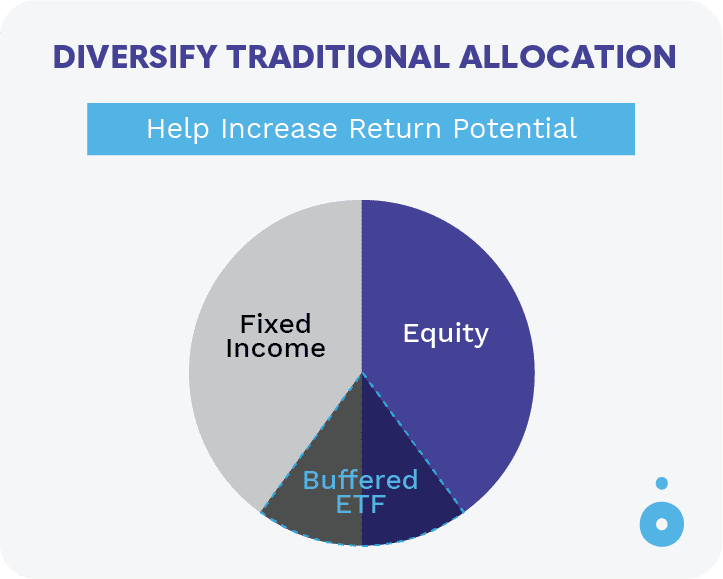

2. Diversify Traditional Allocation – Help Increase Return Potential

- Reposition a share of balanced portfolio to potentially help:

- Increase upside to a cap

- Preserve risk targets

3. Shift Cash Off the Sidelines – Increase Market Exposure

- Reposition a share of cash balance to potentially help:

- Maintain a level of protection

- Upside participation

Looking Back at Market Movements

Buffered ETFs may reduce the impact of volatility by helping protect against significant market events.

Since 1957, calendar year returns for the S&P 500 have been positive 45 times, and negative 18 times. Full year negative returns for the index have occurred 29% of the time. Negative returns for the year have also exceeded 10% nine times, and 20% three times.

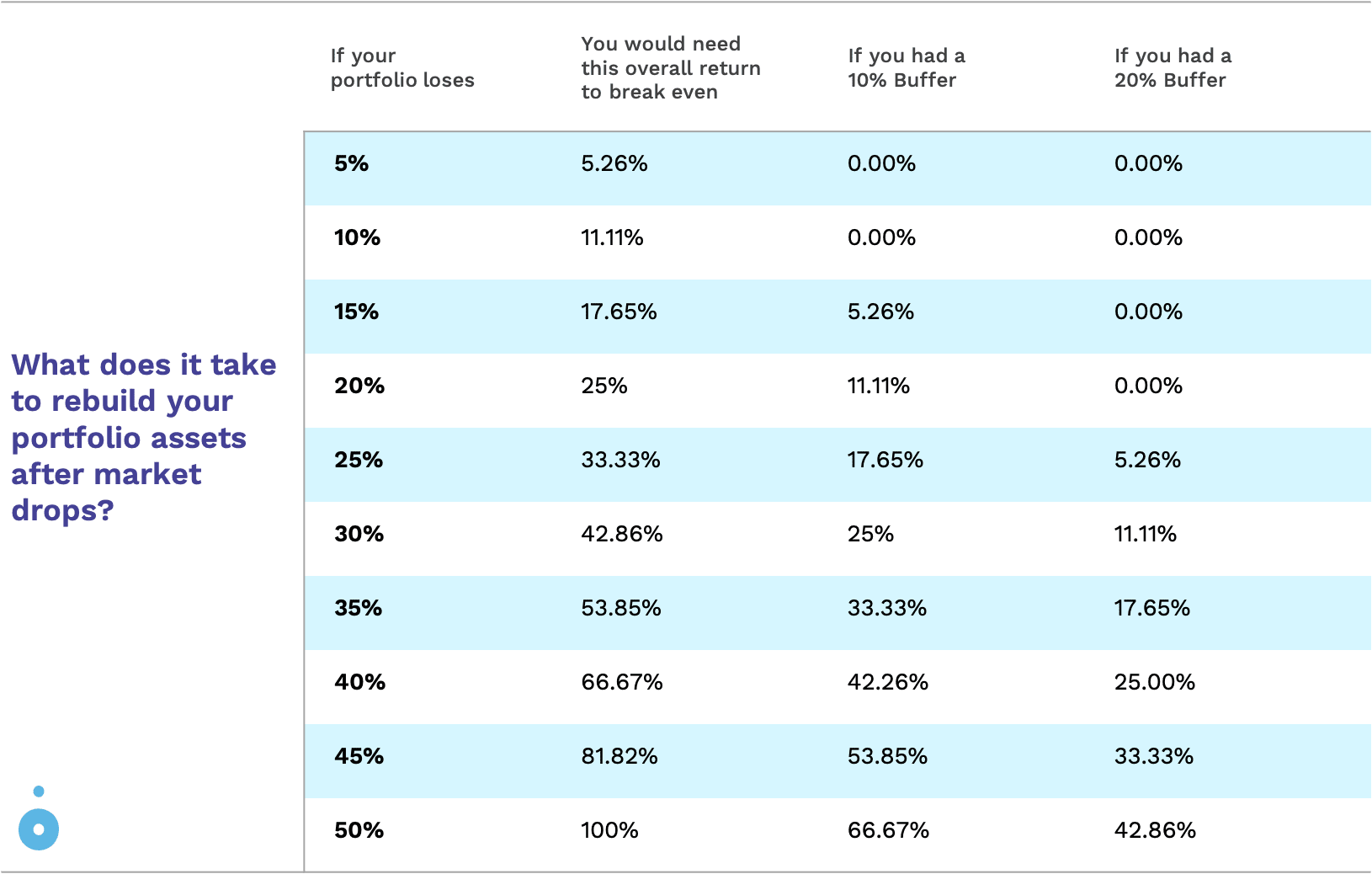

The larger the investment loss, the harder it is to get back to your initial value.

With buffered ETFs you may not have to overcome as much to break even. Below is a table of hypothetical market losses with corresponding returns required to get back to breakeven and the returns required with a buffer on the first 10% or 20% of losses.

Putting It All Together

Today, investing is dynamic and changing faster than ever. Without the right tools to access and manage available investment options, many investors fall short of meeting their goals.

Buffered ETFs are a flexible, risk managed approach to uncertain markets. With downside buffers and upside caps, investors can maintain exposure with a defined outcome for multiple scenarios.

Halo strongly believes the many benefits of a product like buffered ETFs should be available to all investors while being transparent, efficient and with real-time analytics.

Explore Halo’s buffered ETF platform and use the analytics, education and portfolio tools to manage these new strategies to help investors feel confident they will be financially prepared for the future.

Investment involves risk including possible loss of principal. There is no guarantee the funds will achieve their investment objectives and may not be suitable for all investors.

Investors should consider the investment objectives, risks, charges, and expenses carefully before investing. For a prospectus with this and other information about the Fund, please call 877. 429.3837 or visit www.allianzim.com and review the prospectus. Investors should read the prospectus carefully before investing. Distributed by Foreside Fund Services, LLC.

Securities offered through Sentinus-Halo Securities LLC, a SEC Registered Broker/ Dealer and member of FINRA/SIPC. Sentinus-Halo Securities LLC is affiliated with Halo Investing, Halo Investing is not a broker dealer. Sentinus-Halo Securities LLC acts solely as distributor/selling agent and is not the issuer or guarantor of any structured note products.