Who Says Investing Is Passive?

Consider all the financial assets you as an investment advisor own or manage on behalf of your clients: stocks, bonds, mutual funds, exchange-traded funds (ETFs), managed accounts, and maybe even annuities. Many of these investments are packaged products with some form of professional management. Even index mutual funds and ETFs are in a sense “professionally managed” in that they have investment rules defined and managed by index providers and portfolio managers. Aside from owning individual securities, there relatively few purely “passive” investments available.

A Fresh Look at Structured Notes

Structured notes are commonly misunderstood and often mischaracterized. A structured note is simply a packaged investment, in many respects not unlike a professionally managed mutual fund. When investing in a mutual fund, one is outsourcing security selection, portfolio construction, and trading execution to an investment professional. The fund’s portfolio manager, analysts, and traders – a team of investment professionals – do the heavy lifting while investors and advisors focus on other things, such as growing the advisor-client relationship or investor education.

Structured Notes: Perhaps Not So Different After All…

In many respects that sounds quite similar to how structured notes operate. Instead of outsourcing stock and bond selection, the investor or financial advisor looks to professional managers and issuers to create a packaged investment giving them exposure to one or more assets and a customized combination of features, often including full or partial principal protection. In both cases, investors are outsourcing investment activities to financial professionals and benefitting from their expertise.

Getting Familiar with Structured Notes

Structured Notes Benefit from Technology and Competition Through Halo

Perhaps due to years of high and often opaque fees, structured notes have sometimes been criticized as ill-suited investments for individuals to own. However, with Halo’s technology and competitive marketplace, financial advisors now have access to low-cost, readily accessible structured notes that offer protective investment solutions for a growing number of domestic investors. Indeed, Halo works with thousands of registered investment advisors (RIAs) around the country giving them new tools and solutions to build better portfolios and generate superior investment returns.

Outsourcing Is Rational

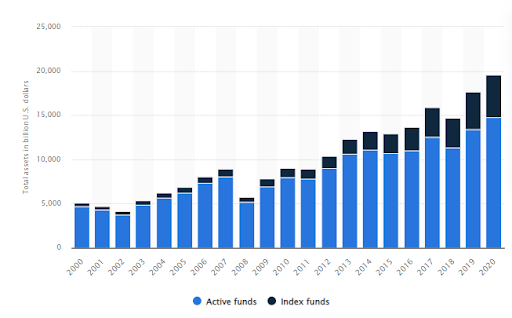

Regarding the similarities between mutual funds and structured notes, it is reasonably safe to say that many investment advisors could easily do their own stock selection given the availability of quality research, financial statements, and analytical tools. So, if outsourcing stock-picking makes sense, which apparently it still does given the trillions of dollars invested in actively managed mutual funds, then outsourcing more complex investment tasks – such as structuring and managing derivatives positions – makes even more sense.

Total AUM of Active and Passive Mutual Funds in the United States From 2000 to 2020

Debunking the “Simple” ETF Myth

While some critics contend that structured notes are just “too complex” – and, in fairness, some might very well be – the same can also be said of many widely held mutual funds and ETFs. Have you ever taken a close look at the holdings in actively managed mutual funds or ETFs? More often than not it is no longer simply IBM and Proctor & Gamble stock! At times, you will see complex derivatives and other esoteric investments in select mutual funds. Typical holdings include futures, swaps, and other so-called “complex” investments. The same goes for many ETFs. Synthetic ETFs often own complex derivatives such as swaps. More recently, an additional layer of environmental, social, and governance (ESG) criteria has been added to the challenging analytical task. Still, investors are conditioned to believe that mutual funds and ETFs are not complex at all.

Conclusion

Structured notes offer investors many potential benefits. Among them is the ability to manage risk, downside protection, and defined financial outcomes. Structured notes also allow investors to access professional risk management and tools not readily available any other way. We encourage all investment advisors to always know what they own and why they own it. Like any investment – simple, complex, or otherwise – it is crucial to understand product terms, benefits, and risks. Halo Investing works with advisors to create impactful solutions for the evolving needs of today’s investors.

Halo Investing is not a broker/dealer. Securities offered through Sentinus-Halo Securities LLC, a SEC registered broker/dealer and member of FINRA/SIPC. Sentinus-Halo Securities LLC is affiliated with Halo Investing Insurance Services and Halo Investing. Sentinus-Halo Securities LLC acts solely as distributor/selling agent and is not the issuer or guarantor of any structured note products.

This document was prepared for investment professionals only and is not intended for general distribution. The comparisons between asset classes and types of security were for illustration purposes only, and are not intended to imply that structured notes have the same structure and the same levels of regulatory protection as mutual funds, ETFs, or even certain derivatives. In addition, liquidity and expenses differ, and structured notes need not conform to certain portfolio limitations imposed by various securities laws. As with any asset, a determination should be made as to what is suitable for and in the best interests of the investor, and neither Halo Investing nor any of its affiliates is attempting to make that determination on your behalf or as a substitute for your own independent investment judgment.