Saving money through your peak earning years is relatively simple. A 401(k) plan, an IRA, and

a taxable brokerage account are not overly complex accounts and do not require much strategy

to create a diversified investment portfolio. It’s also rewarding to see the account balance grow

over time – this helps motivate many folks to continue contributing to their future well-being.

Even other goals, like saving for your children’s college education, can be automated and done

at low cost. Risk-conscious individuals can protect against volatility using structured notes,

annuities, and defined-outcome funds during their prime working years, too.

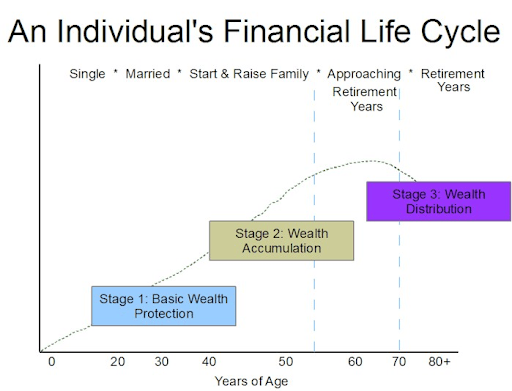

Figure 1: Financial Stages of Life

Source: Thayer County Bank

Managing the Distribution Stage of Financial Life

Want to know what the real challenge is? The drawdown or decumulation phase of life. Do you

have clients who struggle with actually spending what they have worked so hard to save? It

seems odd, but it makes all the behavioral sense in the world. After decades of seeing your net

worth grow, just the thought of it dropping can be nerve-racking. It’s such a 180-degree turn

from being conditioned over many decades to just save, save, save. Goals-based investing is a

common method advisors use to help mitigate the negative effects of this behavioral quirk.

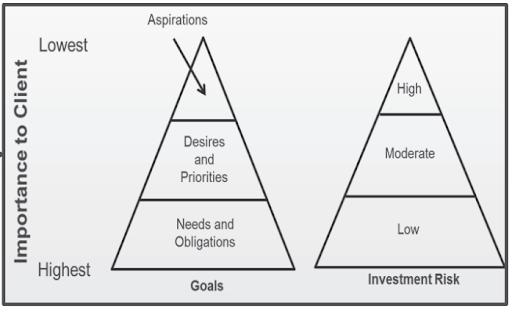

Figure 2: Goals-Based Investing

Source: Kaplan

From a financial planning perspective, the Halo team finds that advisors conclude that the

accumulation phase is relatively easy. It’s when clients enter their distribution years that things

get tricky and goals-based investing can work best. Going from saving to spending is not

something most retail investors are wired for. Halo has a solution to this common

psychologically driven issue that’s, for some reason, not discussed very much compared to

other more technical topics.

Helping Investors Sleep at Night

Advisors can use Halo Investing’s solutions to both mitigate market risk during the accumulation

phase and create a programmatic approach to withdrawals in retirement. Here’s why this works:

Structured notes can, under defined market conditions, protect against some of the downside in

the stock market during a client’s accumulation stage of life while offering attractive yields and

defined-outcome payouts. This helps the more risk-averse slice of the investing population

sleep easier at night. After all, the most optimal portfolio you can craft on a spreadsheet means

nothing if the client panics at the wrong time. In this scenario, notes can be used for investors

aged 30-65 to complement a traditional portfolio of low-cost index funds to adjust the risk/return

profile.

A Realistic Retirement & Sequence of Returns Risk

Now picture the hypothetical scenario of a couple in their 60s on the verge of retirement. They

come to your office to update their financial plan and review their Social Security strategy. The

spouses are impressed with how much they have accumulated over the previous 40 years and

look forward to their go-go retirement years of travel, spending time with the grandkids, and not

worrying about money matters.

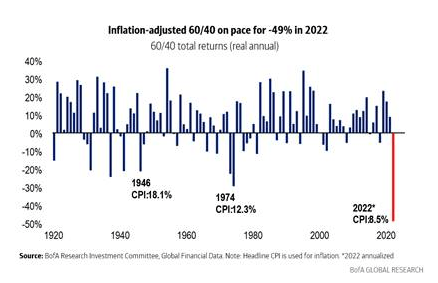

But they aren’t prepared for what’s next. Retirees are sometimes rocked by the sequence of

returns risk – the notion that if the stock and bond market both fall early in their golden years,

that can have a devastating impact on the long-run solvency of their retirement savings. This

year is a good example considering 2022 is shaping up to be the worst year for the 60/40

portfolio in the last century, according to Bank of America Global Research. Inflation makes the

drubbing even worse. Structured notes and annuities are increasingly popular ways to buffer the

risks of declining stock prices, rising interest rates, and stubbornly high inflation.

Figure 3: Inflation-Adjusted 60/40 Portfolio Pacing for its Worst Year (2022’s return is

annualized)

Source: BofA Global Research

Using Fee-Based Annuities in the Distribution Phase

Fee-based annuities are a solution to both behavioral biases among retirees and the technical

task of taking annual Required Minimum Distributions (RMDs). An annuity provides clients with

a monthly income stream that can mimic the feeling of a paycheck from their working years.

Advisors can tailor the annuity so that it hits the right amount of retirement account withdrawals

to satisfy RMDs, too. Finally, this works well psychologically since the client does not have to hit

the “sell” button in order to receive cash from their nest egg.

Additionally, structured notes can be appropriate during the distribution phase. For example,

depending on the age and risk tolerance of an investor, a 65 to 70 year old may find an income

note with deep protection at maturity appropriate for enhancing monthly yields while helping to

satisfy RMDs. The income note carries its own risks and benefits, but it can be used alongside a

traditional retirement portfolio.

Halo’s Practical Solutions

Halo is all about helping advisors with real-world issues. Advisors face a challenge in educating

clients, but also in managing clients’ emotions and natural behavioral biases. The good news is

that there are competitive products today that can be a happy middle ground between the

spreadsheet-driven optimal solution and an outcome that ‘feels good’ to the client.

Conclusion

Halo Investing offers advisors a marketplace of structured notes, annuities, and defined-

outcome funds with transparent and low costs. Our Advisor Note program can be used to help

clients during their accumulation phase of life, and fee-based annuities can be tailored to

retirees’ needs during the important distribution phase.

Halo Investing is not a broker/dealer. Securities offered through Sentinus-Halo Securities LLC, a

SEC registered broker/dealer and member of FINRA/SIPC. Sentinus-Halo Securities LLC is

affiliated with Halo Investing Insurance Services and Halo Investing. Sentinus-Halo Securities

LLC acts solely as distributor/selling agent and is not the issuer or guarantor of any structured

note products.

.jpg)

.jpg)